tax on unrealized gains india

Under current law the top income tax rate for capital gains is 20 percent while the top income tax rate for other types of income is 37 percent. This means you dont have to report them on your annual tax return.

Strategies For Investments With Big Embedded Capital Gains

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

. This expenditure is a temporary difference for deferred tax purpose hence needs to be accounted for calculation of deferred tax. If you buy a share for Rs100 and next day the share price is 110 then in such context - 1. If your Income is comprised of Capital gains that come under a special tax rate you cannot save on tax outgo on the same by Investing in PPF.

If you dont sell the share Rs10 is your unrealized gain. If you dont sell the share Rs10 is your unrealized gain. Tax Breaks under section 80c to 80U is not available to Capital gain Income.

Tax on unrealisednotional foreign exchange gain. Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. I mean it wouldnt make a ton of sense to tax a gain that hasnt even actually occurred yet right.

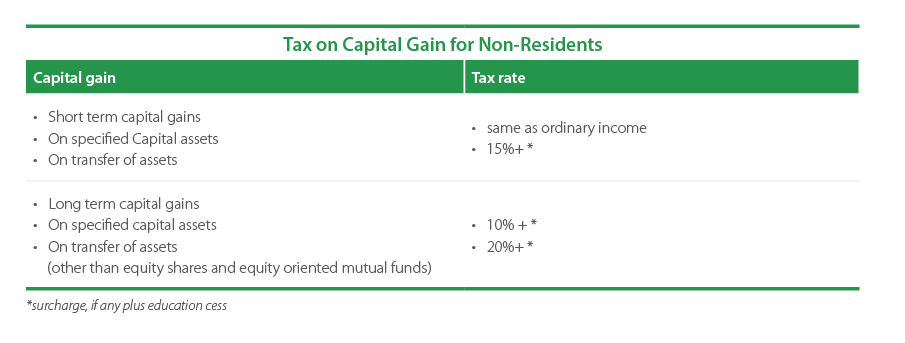

Long-term Capital Gain on equity shares listed on the recognized stock exchange or equity-oriented Mutual Funds on which STT is paid is taxed at 104 if the gain is above Rs 1 Lakh during the financial year. 6 hours agoThe following Tax Rates have been prescribed under Income Tax Act for Capital Gain on the sale of Shares or Mutual Funds. Any unrealized profit would not be chargeable to tax and is not reportable on your tax return.

Only in case of realized gains do you have to pay taxes in case of a mutual fund. Further you will need to file your India tax return using Form ITR-2. It is realized loss on exchange rate.

Interest income received by a foreign company is taxed at a concessional rate of withholding at 520 subject to conditions. If you sell the share then Rs10 becomes your realized gain which is absolute profit to you and would be taxable. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to.

For companies engaged in manufacturing business and opting to pay corporate tax at the lower rate interest income shall be taxable at 2517 including applicable surcharge and education cess. As held in Woodward Governer India Pvt Ltd case Loss on exchange fluctuation arising on mark to market losses in respect of loan taken for revenue purposes is allowable as a deduction while computing Profits. Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation.

It mean that you lose 247 20247 200. Where there are unrealized gains - no tax is payable as you have not booked any profits. A capital gains tax CGT is a tax on capital gains the profit realized on the sale of a non-inventory asset that was purchased at a cost amount that was lower than the amount realized on the sale.

VAT Amount will be paid to tax admin as KHR. Yellen had first proposed the tax on unrealised capital gains in February 2021. Tax saving us 80C to 80U is not allowed to Capital gains.

The budget proposes that households worth more than 100 million pay at least 20 in taxes on both income and unrealized gains-- the increase in an unsold investments value. Simple answer they dont. Capital Gains Taxation in India.

Unrealized gains are not taxed because theyre gains that youre only seeing on paper and nothing has been finalized. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. Unlike realized gains that are taxed every time you sell.

Answer 1 of 2. Please clarify on the following issue. For example if you were ahead of the curve and bought bitcoin for 100 and now its worth 9100 you have an unrealized gain of 9000.

Some of the key points are. It is realized or unrealized gain or loss on exchange rate. He estimated that taxpayers subject to our proposal have unrealized gains totaling about 75 trillion in 2022.

Capital gains are only taxed if they are realized which means you dispose of the asset. It has no tax implications but just is an indicator to suggest you as where you are moving. Capital gains tax in India Important rules to be aware of.

Calculate gain or loss on exchange. VAT amount will be paid to tax admin 200 x 4100 KHR 820000. High-income people also pay an additional 38 percent tax to fund health care on both earned income and investment income like capital gains so including that the top rates are 238 percent for capital gains and 408.

If these households realize 6 trillion of their 75 trillion of that gain during. 13 May 2009 Unrealised gains since belong to a loan taken for purchase of capital assets the same will be charged to P L Account as per As 11 Before amendment and as per tax the same would not be allowed. Gains exceeding INR 100000 made on sale of listed equities of an Indian company units of an Indian equity oriented fund and units of an Indian business trust would now be subject to a 10 tax.

If you sell the share then Rs. It has no tax implications but just is an indicator to suggest you as where you are moving. Unrealized gains are not taxed by the IRS.

Investors may choose to sit on unrealized gains for tax benefits. A tax on unrealized gains would harm the economy. This does not affect the application of the STT which must be paid in the usual manner.

Padmaraj Analyst 25 Points 01 July 2010. Such buy-back tax has been extended to listed companies vide Finance Act 2019. The most common capital gains are realized from the sale of stocks bonds precious metals and property.

So once you sell your Mutual funds and the funds are credited to your bank account you have to compute your tax liability and pay capital gains taxes on the same. Below are one economists estimates of what the top 10 wealthiest Americans would. India tax laws levy buy-back tax at the rate of 23296 percent on the buy-back of shares by an unlisted company to the extent of the amount distributed over the amount received by the company from the shareholders on issuing the shares.

Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains. Most assets held for more than one year are taxed at the long-term capital gains tax rate which is.

Capital Gains Tax In India An Explainer India Briefing News

Strategies For Investments With Big Embedded Capital Gains

Strategies For Investments With Big Embedded Capital Gains

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What Is Capital Gain Tax Of Capital Gains In India Fincash

Strategies For Investments With Big Embedded Capital Gains

Strategies For Investments With Big Embedded Capital Gains

What Is A Long Term Capital Gains Tax In India Quora

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Do You Have To Pay Capital Gains Tax In India What Is Ltcg And Stcg

Sme Capital Gains Tax Who Actually Gains By Amarit Aim Charoenphan The Aim Is The Way Medium

Do You Know What Is The Mutual Fund Taxation For Fy 2020 21 Advisorkhoj

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

How To Avoid Paying Tax On Short Term Capital Gains In India Quora

How To Calculate Capital Gains On Sale Of Gifted Property Examples