peoples pension tax relief

If I dont earn enough to pay income tax how do I claim tax relief on my contributions. Solve Your IRS Tax Debt Problems.

The People S Pension Moneysoft

The Peoples Pension appoints new Trustee Chair 3rd May 2022.

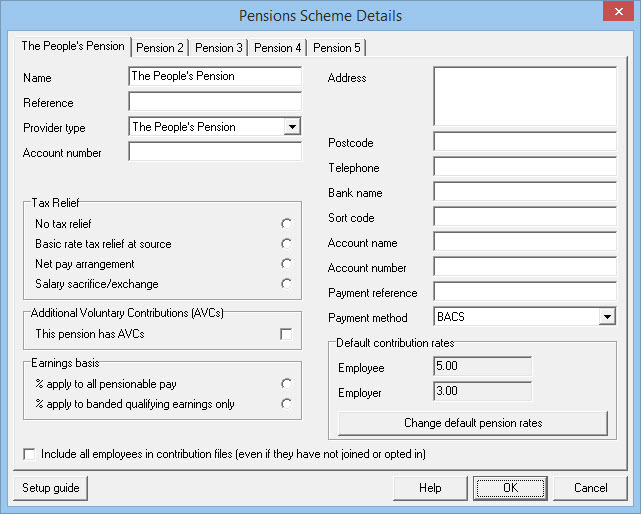

. Provide Tax Relief To Individuals and Families Through Convenient Referrals. Compare Us Save. Account Number Enter the account number allocated to you by The Peoples Pension during the set up of your.

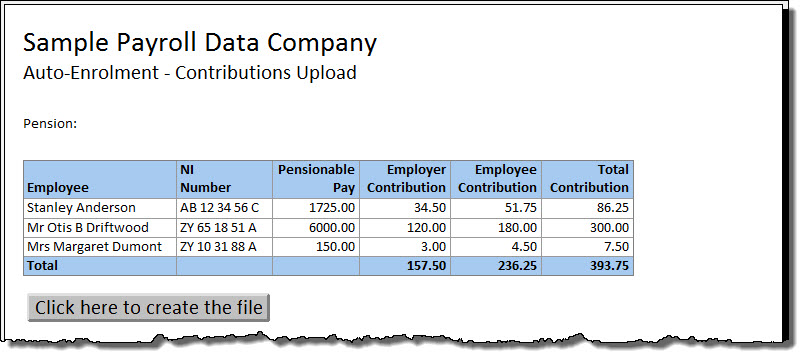

Download Fisher Investments free guide Is a Lump Sum Pension Withdrawal Right for you. Trusted by Over 1000000 Customers. The Peoples Pension offers the complete pension package to meet the unique needs of any organisation large or small in any sector.

Any pension contributions that you make over this limit are. Ad Based On Circumstances You May Already Qualify For Tax Relief. BCE provider of The Peoples Pension has called for the current system of pensions tax relief to be replaced by a flat rate set high enough above the basic rate to.

With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. You automatically get tax relief at source on the full 15000. The key research findings were.

Ad As Heard on CNN. 800-352-3671 or 850-488-6800 or. Calling toll-free 1-866-805-0990 or 518-474-7736 in the Albany New York area.

Relief at source is a way of giving tax relief on contributions a member makes to their pension scheme. Ad Client Recommended Services. - BBB A Rating.

Expert Reviews Analysis. Relief at source means your contributions are taken from your pay after your wages are. Provide Tax Relief To Individuals and Families Through Convenient Referrals.

Ad 5 Best Tax Relief Companies of 2022. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes. More than half of UK households arent.

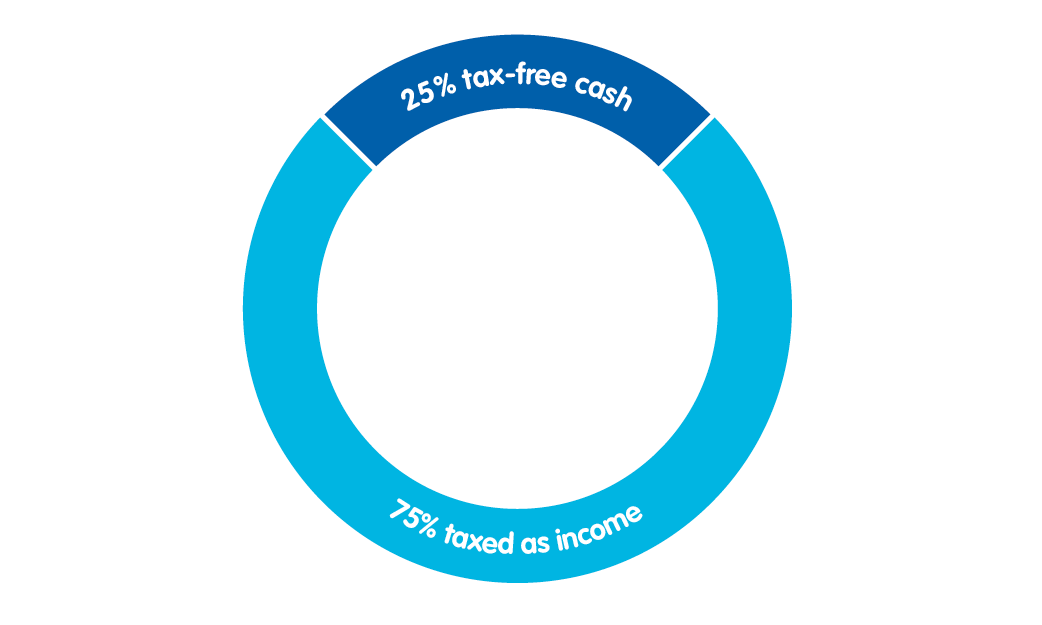

Then The Peoples Pension claims 20 in tax relief adding an extra 2 to Mikes pension pot the same 20 rate as a basic rate taxpayer. 40000 annual allowance gross If as outlined above you. Each employee pays a bit into a pension pot.

Peoples Tax Relief offers tax relief services to help US. If an employee does not earn enough to pay Income Tax they can still receive tax relief on pension contributions. The tax relief is currently available on contributions up to a.

With relief at source the amount you see on your payslip is only your. For 202223 you can get tax relief on pension contributions up to 40000 or 100 of your salary whichever is lower. Get Tax Relief from Top Tax Relief Services.

My employer is deducting contributions before tax is taken from my wages. The Peoples Tax Relief staff includes Enrolled Agents EAs Certified Public Accountants CPAs and tax attorneys with experience in the tax industry. For more information about tax relief please visit our pension tax webpage.

The combination of paying more tax and coping with a cost of living crisis could force millions of households to the brink. A Rated BBB Member. This means tax relief cannot be.

Retirement income exclusion from 35000 to 65000. If you earn 3600 or less a year or you dont earn anything at. Four in ten 41 adults correctly believed that the government tops up.

You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000. Pension Tax Relief 27 of people surveyed did not know how it worked. The current maximum amount is the lower of either of the following.

To encourage saving for retirement the government pays tax relief on pension contributions. Get Instant Recommendations Trusted Reviews. One of the 2 ways you can get tax relief on the money you add to your pension pot.

Ad See the Top 10 Tax Relief. 100 of your total UK earnings in a tax year. Provider type Select The Peoples Pension from the drop-down list.

Receive Options Quote With No Obligation. - BBB A Rating. Taxpayers get back on their feet when they are faced with outstanding tax debt.

Salary sacrifice pension tax relief. If you made after-tax contributions to NYSLRS while you were working a small portion of your pension may. Ad Could increased liquidity give you more control over your 500K in retirement savings.

The threshold for higher rate tax is 50270. Solve Your IRS Tax Debt Problems. Compare the Top Tax Relief and Find the One Thats Best for You.

Ad Based On Circumstances You May Already Qualify For Tax Relief. When you earn more. If your pension contributions are taken after tax the government will still give you tax relief at the basic tax rate of 20 as follows.

Many people were not aware of the tax system in place for pensions. Ad Do You Owe Over 10K in Back Taxes to the IRS. Steven Cameron pensions director at Aegon warns that reducing or abolishing higher-rate tax relief will deter some higher earners from.

Ad As Heard on CNN. Get a Free Qualfication Analysis. Members will get tax relief based on their residency status at the.

You put 15000 into a private pension. More If youd like more information on tax relief. Salary sacrifice pension tax relief.

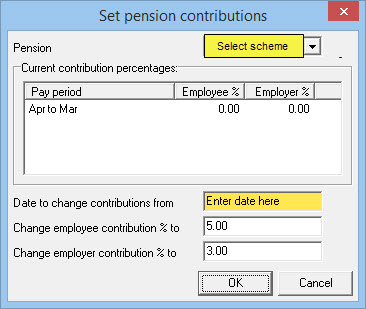

You can claim. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. When you set up your workplace pension with The Peoples Pension you can choose to deduct your.

We offer an exclusive 3-step Tax. End Your Tax NightApre Now. Those paying 40 income tax are entitled to 40 pensions tax relief on contributions and 50 taxpayers are entitled to 50 tax relief although this will drop to 45.

Salary Sacrifice Workplace Pensions The People S Pension

The People S Pension Moneysoft

Tax Relief On Your Pension Youtube

Pension Tax Tax Relief Lifetime Allowance The People S Pension

Pension Tax Tax Relief Lifetime Allowance The People S Pension

The People S Pension Moneysoft

Reform Of Pension Tax Relief House Of Commons Library

Tax Relief On Pension Contributions For Higher Rate Taxpayers Taxassist Accountants

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

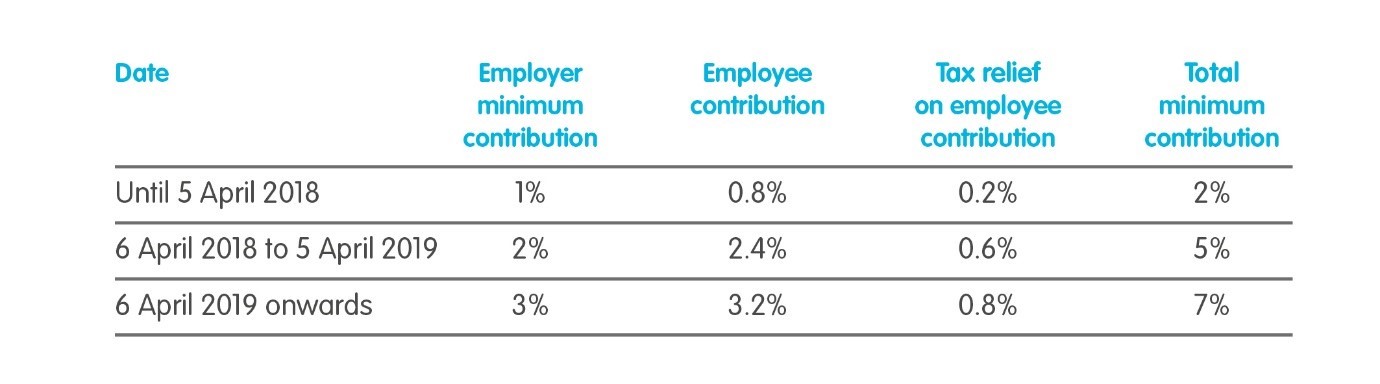

Workplace Pension Contributions The People S Pension

60 Tax Relief On Pension Contributions Royal London For Advisers

What Is Pension Tax Relief Nerdwallet Uk

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

How Do Pensions Work Moneybox Save And Invest

Ssia Style State Pension Top Up Under Consideration For Auto Enrolment Scheme

Pension Tax Tax Relief Lifetime Allowance The People S Pension

60 Tax Relief On Pension Contributions Royal London For Advisers

How Pension Tax Relief Works And How To Claim It Wealthify Com

How To Claim Higher Rate Tax Relief On Pension Contributions Unbiased Co Uk